Estate and Planned Giving

Planned Giving

We encourage you to consult your financial adviser to determine the ways to match the needs of your family when making your donation to the Prairie Ridge Health Foundation.

Estate Planning Seminar Video Series

|

Video 1: What is Estate Planning and an introduction to Wills and Trusts |

Video 2: How to Skip Probate and Understanding the Use of Beneficiaries |

Video 3: Giving Throughout Your Lifetime |

Resources:

|

|

|

| Leave a Legacy - Ways of Giving Guide |

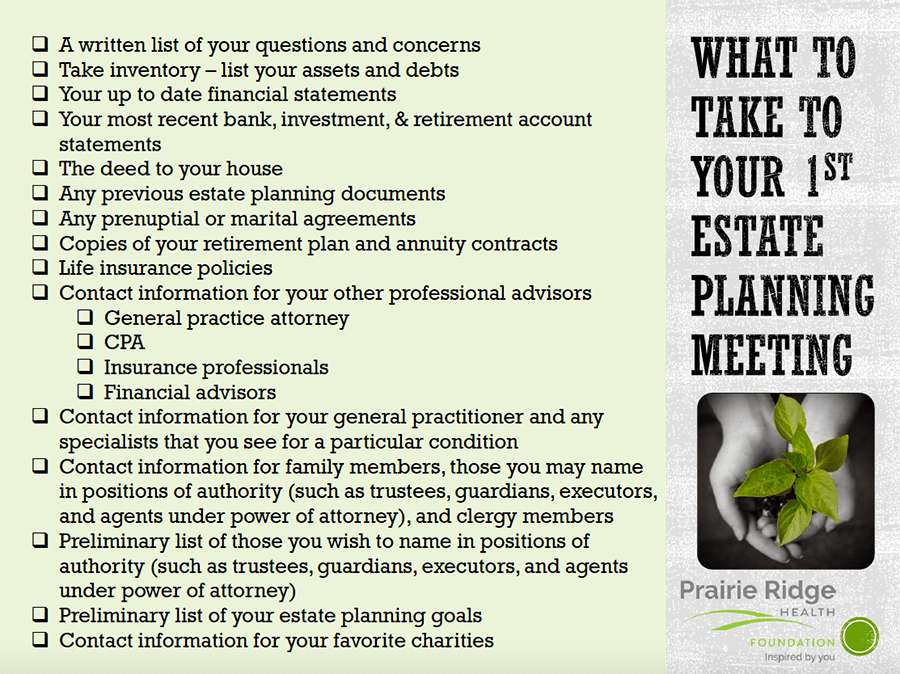

Estate Planning Checklist |

Request a Free Planned Giving Resource Guide

Bequests and Giving Through Wills

By remembering Prairie Ridge Health Foundation with a bequest in your will, you can positively impact your community's healthcare in a way that endures beyond your lifetime. Your bequest will qualify for an estate tax charitable deduction. When making a bequest, we urge you to consult with your attorney and other advisers.

Charitable Lead Trust

A trust created to produce income payable to the Prairie Ridge Health Foundation, usually for a term of years. Your trust assets then pass to subsequent family generations. This is a useful technique if you own a large estate and want to transfer wealth to successive generations in a tax-advantaged way.

Living Trusts: Revocable and Irrevocable

A Living Trust is created for the purpose of maintaining ownership of your assets during your lifetime, and distributing your assets to charitable institutions, like the Prairie Ridge Health Foundation, after death. Its creator cannot revoke an Irrevocable Living Trust.

Life Insurance

A gift of life insurance by naming Prairie Ridge Health Foundation as a beneficiary.

Retirement Plans

Pensions, 401K plans, 403B plans and IRAs. If you are over the age of 70 1/2 you will be required to take out a "Required Minimum Distributions (RMDs)." You can choose to use that money as a donation to a qualified charitable organization, tax-free.

Charitable Remainder Annuity Trust & Gift Annuity Agreement

Both of these arrangements will pay income to you or your beneficiary(s) during your lifetime. The principal then passes to the Prairie Ridge Health Foundation upon the death of the last beneficiary. These are excellent gifts for your smaller gifts.

Pooled Income Fund

Purchases may be made in a commingled trust that pays income to you or other beneficiary(s) during your lifetime. The principal passes to the Prairie Ridge Health Foundation upon the death of the last beneficiary.

Additional planned giving can be done through Real Estate Agreement, Endowment Funds, Real Estate, Life Insurance Endowment Program and Appreciated Securities.

For more information, consult your financial adviser or contact the PRH Foundation Director at (920) 623-1370.